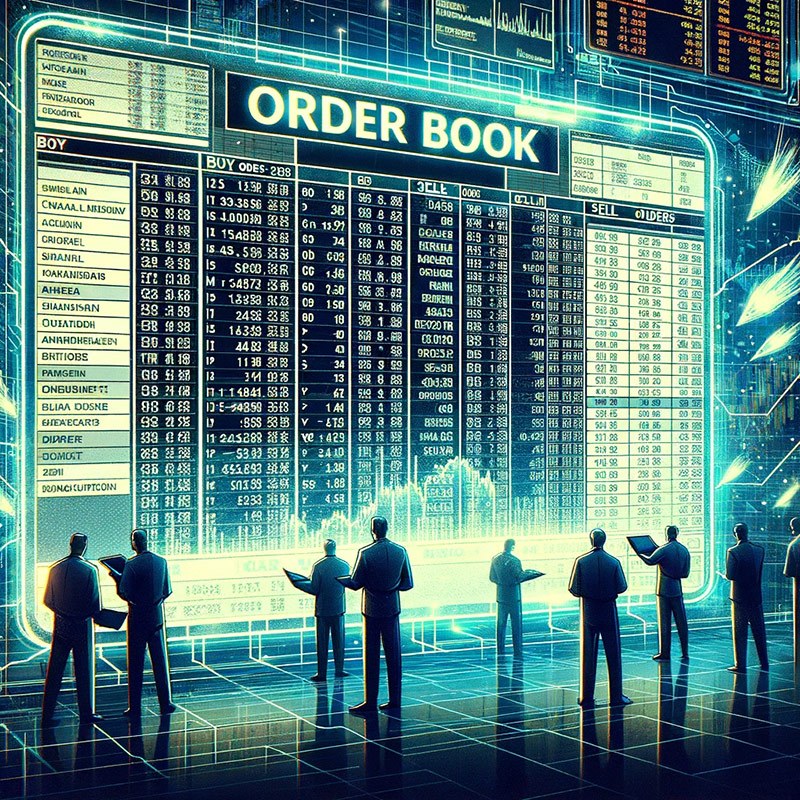

The Order Book in the stock market is like a dynamic digital scoreboard that displays real-time interest in a company’s shares. It’s an electronic record showing how many shares people want to buy or sell and at what prices. This tool is crucial for anyone trading in the stock market because it provides a clear and current picture of what’s happening with a particular stock.

What’s in an Order Book?

The Order Book lists all the buy and sell orders for a stock. These orders are placed by investors and traders who want to buy or sell shares at specific prices.

- Buy Orders: These are listed on one side of the Order Book. They show the prices buyers are willing to pay for the stock and how many shares they want to buy. The highest price offered by a buyer sits at the top of this list because it’s the most attractive offer to sellers.

- Sell Orders: On the other side, you’ll find sell orders. These show the prices at which sellers are willing to part with their shares and the number of shares they wish to sell. The lowest price here gets the top spot, as it’s most appealing to buyers.

Why the Order Book Matters

The Order Book is like a window into the market’s soul, showing the supply and demand for a stock at any given moment. Here’s why it’s important:

- Price Clarity: It helps you understand at what prices the stock might be bought or sold. You can see the exact price points where there is interest in buying or selling.

- Market Sentiment: It gives a snapshot of how people are feeling about a stock. Lots of buy orders at increasing prices might indicate positive sentiment, while numerous sell orders could suggest the opposite.

- Trading Decisions: Traders use the Order Book to help decide when to buy or sell. For example, if there are many buy orders at higher prices, a trader might anticipate the stock’s price will go up and decide to buy.

Order Book in Action

Think of a popular company’s stock. The Order Book for this stock will show many buy orders at various prices, with higher prices indicating strong demand. Similarly, the sell side will show how many shares are up for grabs and at what prices sellers are willing to sell. This ongoing list changes constantly as new orders come in and old orders are fulfilled or withdrawn.

In essence, the Order Book is a vital tool in the stock market, offering transparency and guiding investors in making more informed trading decisions. It’s a real-time reflection of how much interest there is in a stock and at what price, making it a key resource for navigating the stock exchange.